Equestrian Properties in Foothills County – What Buyers Should Know

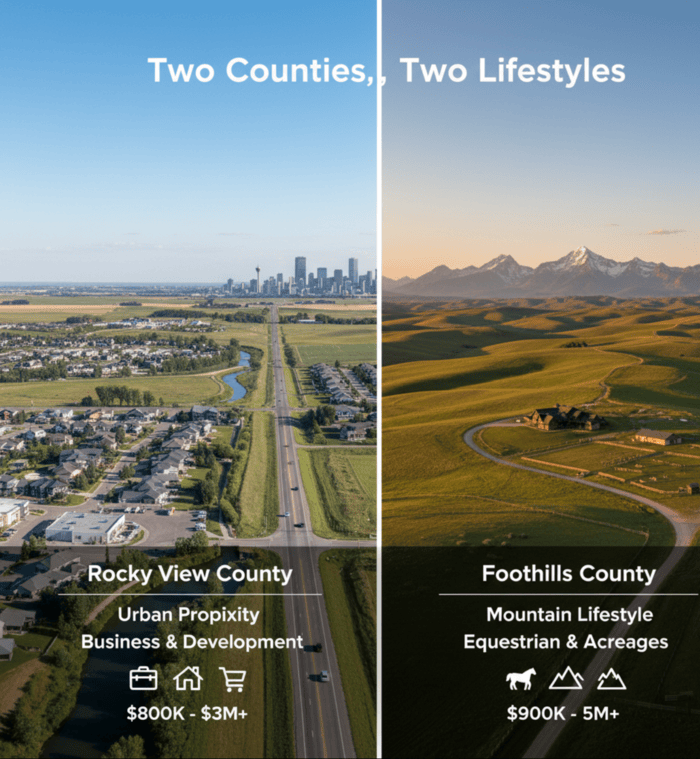

Foothills County stands as Alberta's premier destination for equestrian enthusiasts, offering exceptional horse properties ranging from intimate hobby farms to world-class training facilities. With its proximity to Calgary, stunning mountain views, and horse-friendly zoning regulations, the region attracts serious equestrian buyers seeking the perfect balance of rural lifestyle and urban accessibility. This comprehensive guide explores everything potential buyers need to know about equestrian properties in Foothills County.

Essential Facts for Equestrian Property Buyers

Zoning Basics: Foothills County allows 1 horse per 3 acres without development permits. A 30-acre property accommodates up to 10 horses without additional approvals. Higher densities require permits demonstrating adequate facilities, water supply, and manure management.

Property Size Guidelines: 2-5 acres suitable for 1-2 horses (hobby farms), 5-10 acres for 3-4 horses (personal operations), 10-20 acres for small boarding (5-7 horses), 20-40 acres for medium operations (8-13 horses), 40+ acres for commercial training and breeding facilities.

Critical Infrastructure: Reliable well (minimum 3-5 GPM for basic operations, 8-10 GPM for boarding), quality horse-safe fencing ($3,000-$8,000 per acre), proper barn facilities with ventilation and drainage, heated winter water systems ($500-$2,000 per waterer), all-weather road access for horse trailers.

Investment Value: Well-developed equestrian properties command $100,000-$500,000+ premiums over raw land. Indoor arenas add $150,000-$400,000 to property values. Properties near trail systems appreciate 10-15% faster than non-recreation locations.

Top Communities: Priddis (35-45 min to Calgary, strong equestrian culture), Millarville (40-50 min, excellent trails), De Winton (15-25 min, great value), Okotoks (30-40 min, full amenities).

Understanding Foothills County's Equestrian Zoning

Foothills County's Land Use Bylaw provides specific guidelines for equestrian properties and livestock operations. Understanding these regulations is crucial before purchasing any rural property in Foothills County.

Animal Unit Regulations

The county uses an animal unit system to regulate livestock density on properties:

- 1 horse = 1 animal unit

- Baseline allowance: 1 animal unit per 3 acres without a development permit

- Higher density: More than 1 unit per 3 acres requires a development permit

- Maximum capacity: Varies by specific property size and zoning designation

Example: A 30-acre property allows up to 10 horses without additional permits, while higher densities require formal approval through the county's development process demonstrating adequate water, waste management, and facility standards.

Permit Requirements for Higher Density: Applications must show adequate well capacity, septic or manure management systems, proper fencing and containment, shelter facilities meeting animal welfare standards, and compatibility with surrounding land uses.

Zoning Designations for Horse Properties

Most equestrian properties in Foothills County fall under these zoning categories:

- Agricultural (A) - Primary farming operations with unlimited horse keeping potential; suitable for commercial breeding, training, or boarding operations

- Country Residential (CR) - Rural residential with livestock permissions subject to density limits (typically 1 unit per 3 acres); ideal for personal horse ownership

- Direct Control District (DCD) - Custom zoning for unique equestrian operations requiring specialized standards or mixed-use development

Always verify the current zoning designation and permitted uses with the Foothills County planning department (403-652-2341) before making an offer. Review the complete Keeping of Livestock regulations for detailed requirements.

Development Permits for Equestrian Facilities

⚖️ When Permits Are Required

Foothills County requires development permits for several equestrian activities and structures:

- Limited Public Arenas - Any riding arena used by non-residents for lessons, training, or events

- Commercial boarding operations - Facilities housing horses for profit; typically 5+ horses not owned by property owner

- Training facilities - Properties offering riding lessons, clinics, or horse training services to the public

- High-density livestock - More than 1 animal unit per 3 acres (e.g., 15+ horses on 30 acres)

- Major facility construction - Large barns (4+ stalls), indoor arenas, or specialized equine buildings over certain size thresholds

- Accessory buildings - Structures must not exceed 60% lot coverage per property regulations

- Height restrictions - Principal buildings limited to 12m (39.37 ft), accessory buildings to 10.67m (35 ft)

Application Process: Submit site plans, facility specifications, and operational details to Foothills County Planning Department. Processing typically takes 4-8 weeks depending on complexity. Application fees range $500-$2,000 based on project scope. Consult with county planners early in design phase (pre-application meetings free) to ensure compliance and streamline approvals.

Recent Permit Examples

Recent approvals demonstrate the county's support for quality equestrian development. White Moose Farms near Priddis received approval for a comprehensive facility including a 22,167 square foot indoor arena, 28-stall barns, and professional training facilities, showing the county's willingness to approve well-planned equestrian operations that meet community standards and demonstrate proper infrastructure.

Essential Property Features for Horse Owners

Acreage Requirements

While Foothills County regulations allow horses on smaller parcels, practical considerations suggest minimum acreage requirements:

- 2-5 acres: Suitable for 1-2 horses with excellent pasture management, rotational grazing, and significant hay supplementation; requires sacrifice paddocks for winter

- 5-10 acres: Comfortable space for small personal horse operations (3-4 horses) with adequate pasture rotation and seasonal management

- 10-20 acres: Ideal for larger personal herds or small boarding operations (5-7 horses); allows proper facility spacing and pasture rest

- 20-40 acres: Medium-scale boarding, training facilities, or breeding programs (8-13 horses); supports commercial operations with multiple facilities

- 40+ acres: Large commercial operations, extensive training facilities, or working ranches (14+ horses); ideal for serious breeding or training programs

Important Note: Properties under 80 acres are typically limited to one single-family dwelling and one secondary suite or temporary dwelling, while parcels 80 acres or larger may accommodate up to two dwellings - important for properties with manager's quarters or guest accommodations.

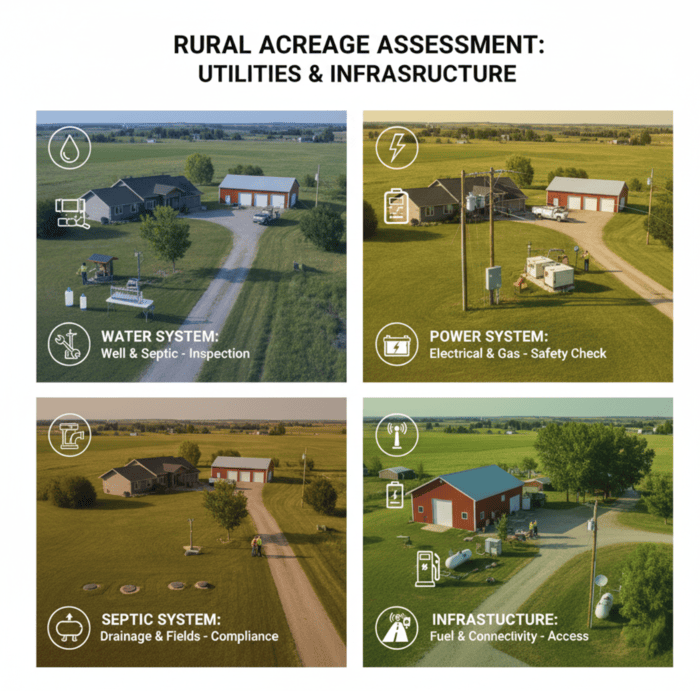

Water Supply Considerations

Reliable water supply represents the most critical infrastructure element for equestrian properties. Horses require 5-10 gallons of water daily per animal, with requirements increasing during hot weather, lactating mares, or performance horses in training.

Essential Water System Requirements:

- Well flow rate: Minimum 3-5 gallons per minute for basic horse operations (1-4 horses); 8-10 GPM strongly recommended for boarding facilities (5+ horses); 12-15 GPM for large commercial operations

- Well depth and recovery:Deeper wells (200+ feet typical in Foothills) with good recovery rates provide more reliable long-term water supply; shallow wells (

- Water quality testing: Essential for both horses and human consumption; test for bacteria (E. coli, Total Coliforms), minerals (iron, manganese, hardness), nitrates, arsenic, and pH levels; horses sensitive to water quality affecting consumption

- Winter systems: Heated waterers or frost-free systems absolutely essential for year-round access in Alberta's climate; budget $500-$2,000 per automatic waterer; alternative: insulated frost-free hydrants with heated troughs

- Storage capacity: Backup water storage (minimum 500-1000 gallons) for power outages or equipment failure; larger operations should consider 2,000-5,000 gallon cisterns

- Pressure and distribution: Adequate pressure (40-60 PSI) to supply multiple barn locations and outdoor waterers simultaneously; pressure tanks and booster pumps if needed

- Backup systems: Consider secondary well, cistern storage, or water delivery access for critical operations; commercial boarding facilities should have redundant systems

- Maintenance access: Wells should be accessible year-round for servicing; well houses protect equipment from weather and provide easier winter maintenance

Always conduct comprehensive well and septic inspections ($300-$600) before purchasing any rural property. Request well logs showing depth, static water level, drilling records, water quality test results (within 6 months), pump service history, and recovery rate information. Budget $1,500-$5,000 for well pump replacement every 10-15 years.

Septic System Capacity

Properties with horse facilities require adequate septic capacity for both residential and barn use. Barn wash bays and heated barn areas generate additional wastewater that must be properly managed. Standard residential septic systems (3-bedroom sizing) may be inadequate for properties with extensive barn facilities, riding arenas, or boarding operations.

Key Septic Considerations:

- Verify septic system size, age (typical lifespan 20-30 years), and condition during inspections

- Commercial operations may require larger systems or separate commercial septic approval

- Alberta Health Services approval required for septic systems; verify compliance with current standards

- Budget for potential system upgrades ($8,000-$20,000 for standard replacement; $15,000-$30,000 for advanced systems)

- Maintain adequate reserve area for future field replacement (typically equal area to existing field)

Fencing and Containment

Quality fencing represents both a safety necessity and significant investment consideration. Budget $3,000-$8,000 per acre for quality horse fencing installation:

- Recommended fencing: Wood board (most popular, $7-$15 per linear foot, requires regular maintenance), vinyl (low maintenance, $15-$25 per linear foot, excellent longevity), or electric tape/wire designed for horses ($1-$3 per linear foot plus posts, effective containment)

- Avoid: Barbed wire (poses severe injury risks to horses including deep cuts requiring sutures, leg entanglement causing panic and broken bones, permanent scarring affecting show horse value, eye injuries from contact); page wire/woven wire can cause leg entrapment

- Height requirements: Minimum 4.5-5 feet for standard horses; 5.5-6 feet for larger breeds, stallions, or horses known to jump; consistent height prevents testing boundaries

- Gate systems: Wide gates (12-16 feet) for horse and equipment access; sturdy construction with proper hardware to prevent sagging; gates should swing freely and latch securely; consider double gates for large equipment access

- Paddock design: Multiple paddocks (3-5 minimum) for rotation, horse management, and pasture rest; allows separation of horses by sex, age, or temperament; facilitates pasture recovery and parasite management

- Corner bracing: Proper corner posts (6-8 inch diameter, set 3-4 feet deep) and bracing to prevent fence line failure; corners take greatest stress and require heavy-duty construction

- Visibility: White or highly visible fencing reduces collision risk, especially in snowy conditions or low light; horses better respect fences they can see clearly

- Safe construction: No sharp edges, protruding nails, or dangerous hardware; smooth, rounded corners reduce injury risk; electric fencing should use visible tape rather than thin wire

Maintenance Planning: Inspect fencing seasonally for damage or wear, repair issues immediately to prevent horse escape or injury, maintain vegetation clearance (grass and weeds touching electric fencing reduces effectiveness), tighten sagging wire or boards, and budget $500-$2,000 annually for repairs and upkeep. Wood fencing requires staining/sealing every 3-5 years ($1-$3 per linear foot).

Facility Infrastructure and Buildings

️ Barn and Shelter Requirements

Alberta's climate necessitates proper shelter for horses, making barn quality a crucial evaluation factor:

- Ventilation systems: Critical for horse respiratory health and building longevity; natural ventilation through cupolas and ridge vents preferred over sealed barns; air exchange without drafts; prevents moisture buildup causing respiratory disease

- Stall dimensions: Minimum 10x10 feet for ponies, 12x12 feet for average horses (most common), 14x14 feet or larger for draft breeds, warmbl oods, or foaling stalls; horses need room to lie down and turn comfortably

- Ceiling height: Minimum 10 feet clearance for horse safety; 12 feet preferred for larger horses; prevents head injuries and improves air circulation

- Feed and tack storage: Secure, rodent-proof storage areas separate from horse areas; climate-controlled space for leather tack prevents mold and deterioration; grain storage in metal bins prevents rodent access

- Electrical systems: Proper wiring for lighting (LED fixtures reduce costs 60-75%), water heaters, and equipment; GFI outlets required near water sources for safety; consider solar backup for critical systems; electrical capacity minimum 100-amp for basic barn, 200+ amp for heated facilities

- Drainage: Adequate systems to prevent moisture accumulation and flooding issues; French drains around barn perimeter; properly sloped floors (2% grade) for cleaning; gutters and downspouts directing water away from foundation

- Flooring: Level, well-draining surfaces; rubber mats recommended for stall comfort and ease of cleaning ($100-$200 per stall); solid footing prevents slipping; concrete aisles for durability and easy cleaning

- Fire safety: Fire extinguishers in multiple locations (near hay storage, tack rooms, heated areas), smoke detectors, clear evacuation routes posted, fireproof tack room with metal door, emergency lighting, fire evacuation plan practiced regularly

- Water access: Frost-free hydrants in barn, heated automatic waterers in each stall or paddock; prevents frozen pipes and ensures constant water access

- Manure management: Designated area for manure storage with proper drainage; composting system or commercial removal service; adequate distance from wells (90m minimum) and property lines (15m minimum)

Construction Costs: Basic barn with 4-6 stalls: $40,000-$80,000; High-quality barn with 6-8 stalls and amenities: $100,000-$250,000+; Costs vary significantly based on size, finishes, and features (heated, insulated, automatic waterers, concrete aisles, tack rooms, wash bays).

Arena and Training Facilities

Indoor arenas provide year-round riding opportunities in Alberta's challenging climate:

- Size considerations: Minimum 60x120 feet for basic riding (adequate for individual riding and training); 80x200 feet ideal for serious training (allows jumps, dressage arena, multiple riders); 100x250+ feet for showing or multiple riders (competition quality); larger arenas support clinics and events

- Footing quality: Appropriate sand, fiber, or specialty footing materials for intended discipline (dressage requires different footing than jumping); depth typically 3-4 inches; budget $10,000-$30,000 for quality footing depending on arena size; requires regular maintenance (dragging, watering, leveling)

- Structural integrity: Engineered buildings to withstand Alberta snow loads (typically 40-50 PSF minimum required); clear-span construction eliminates interior posts for safe riding; professional engineering required for permits and insurance

- Lighting systems: Adequate illumination (20-30 foot-candles) for safe riding day and night; LED fixtures reduce operating costs by 60-75% compared to traditional lighting; consider natural lighting through translucent panels

- Dust control: Watering systems (sprinklers or hoses) or footing additives to minimize dust; critical for horse and rider respiratory health; automatic watering systems save labor

- Temperature control: Insulation or radiant heat for year-round comfort (optional but valuable for serious training); budget $15,000-$40,000 for heating systems; significantly extends usable riding season and horse comfort

- Viewing areas: Heated observation room for lessons and training; provides comfortable space for instructors, students, and visitors; restroom facilities add value

- Door systems: Large doors (14-16 feet high, 12-16 feet wide) for horse and equipment access; consider hydraulic or electric door openers for ease of use

Arena Construction Costs:

- Basic outdoor arena (100x200): $20,000-$50,000 (grading, base, footing, fencing)

- Enclosed arena with basic amenities (80x200): $150,000-$300,000

- Premium indoor facility with heating and full amenities (100x250): $400,000-$800,000+

- Costs include engineering, permits, grading, base preparation, structure, footing, lighting, and basic amenities

Outdoor Riding Areas

Well-maintained outdoor arenas or round pens provide additional training space essential for summer riding:

- Round pens: 50-60 feet diameter for training, groundwork, lunging, and horse starting; $5,000-$15,000 installed with quality footing and panels

- Outdoor arenas: 100x200 feet minimum for versatile use; proper drainage critical (crown in center or slope to perimeter); all-weather footing (sand/fiber mix); $20,000-$60,000 depending on size and quality

- Fencing: Safe, visible arena fencing; wood, vinyl, or pipe rail recommended; minimum 5 feet height; no protrusions or sharp edges

- Maintenance: Regular dragging, watering, and leveling maintain quality riding surface; weed control around perimeter

Location and Accessibility Factors

Proximity to Equestrian Services

Consider access to essential equestrian services when evaluating luxury horse properties:

- Veterinary services: Large animal vets specializing in equine care within 30-45 minutes; emergency services available 24/7; Foothills area served by several excellent equine veterinary practices; response time critical for colic, injuries, or foaling emergencies

- Emergency vet access: 24-hour emergency services for critical situations; know response times to your specific location; keep vet contact information posted in barn

- Farrier services: Professional hoof care providers servicing your area regularly (6-8 week cycles typical); quality farriers often booked weeks in advance; establish relationship early; expect $80-$150 per horse per trim/shoeing

- Feed suppliers: Quality hay, grain, and supplement sources; local hay producers preferred for freshness and cost savings; establish hay sources before winter (October) as supply tightens; budget $150-$300 per ton for quality hay

- Tack shops and supplies: Equipment and supply stores within reasonable distance (Okotoks, Calgary); online ordering supplements but immediate needs require local access

- Training facilities: Access to specialized training, clinics, and instruction; Foothills area features numerous training facilities for various disciplines (dressage, jumping, western, natural horsemanship)

- Trail systems: Public or private riding trail access for conditioning and recreation (see Parks & Recreation Guide); Sheep River Provincial Park offers equestrian camping and trails; Bragg Creek area provides extensive trail networks

- Show venues: Competition facilities for active competitors; Spruce Meadows (world-class show jumping), Millarville Racing and Agricultural Grounds, numerous smaller facilities hosting local shows and clinics

- Equine dentists: Regular dental care providers (annual or biannual visits recommended); budget $150-$300 per horse annually

- Equestrian community: Active riding clubs, associations, and social networks provide education, support, and friendship; Foothills communities known for welcoming, supportive horse culture

Distance from Calgary

Foothills County communities offer varying commute times to Calgary, balancing rural horse property lifestyle with urban employment:

- De Winton: 15-25 minutes to south Calgary; excellent for Calgary commuters wanting close proximity; properties typically 2-40 acres; strong horse community with good services

- Okotoks: 30-40 minutes; excellent town amenities including veterinary clinics, feed stores, tack shops; family-friendly with schools and recreation; properties range from small acreages to larger horse farms

- Priddis: 35-45 minutes; strong equestrian community with established horse culture; spectacular Rocky Mountain views; trail access to Bragg Creek area; premium property prices reflect desirability

- Millarville: 40-50 minutes; excellent trails and rural character; active riding groups and community events; historic racing and agricultural grounds; Crown land trail access; properties typically larger acreages

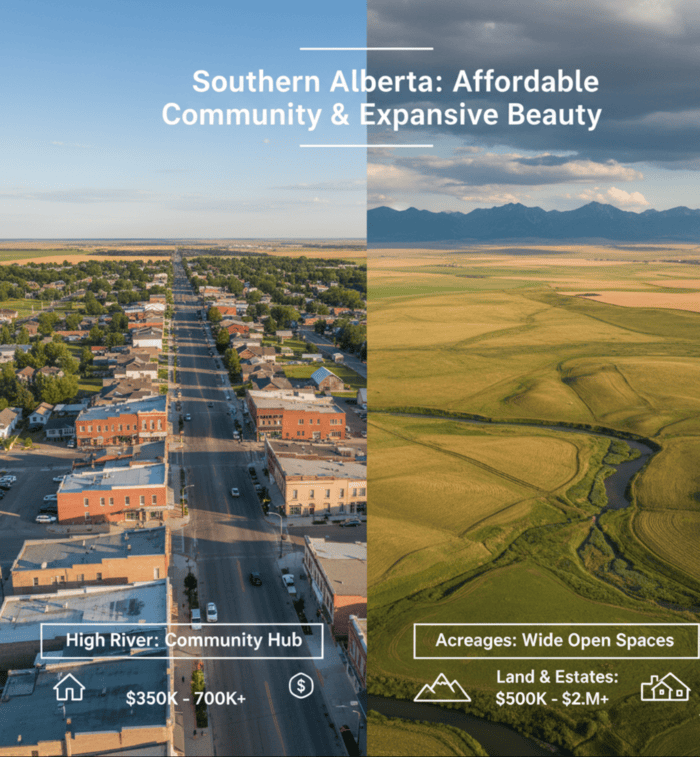

- High River: 45-55 minutes; full-service town with western heritage; rodeo grounds and facilities; often more acreage for competitive pricing; strong agricultural and ranching community

- Turner Valley: 50-60 minutes; close to Sheep River Provincial Park equestrian trails and camping; mountain community character; properties with mountain views and trail access

- Black Diamond: 55-65 minutes; mountain access and extensive trail systems; close to Kananaskis Country recreation; smaller community with rural character

Transportation Considerations

Ensure property access accommodates horse transportation:

- Road access: All-weather road access for horse trailers essential; gravel or paved preferred; minimum 12-foot width; verify road maintenance responsibility (county vs private); some rural roads not maintained winter requiring property owner snow removal

- Road maintenance: Confirm whether roads are county-maintained or private; understand winter snow removal responsibilities; county roads maintained year-round; private roads require equipment or service contracts

- Turning radius: Adequate space for large truck and trailer combinations (40-50+ feet total length); test access with actual equipment before purchase if possible; tight corners or narrow roads problematic for trailers

- Driveway grade: Manageable slopes for loaded horse trailers, especially in winter; maximum 8-10% grade recommended; steeper grades dangerous with loaded trailers on ice; test in winter if possible

- Driveway surface: Gravel minimum for adequate traction; paved ideal for year-round access; proper drainage to prevent washout; width minimum 12 feet for trailer access; 16 feet preferred for two-way traffic

- Bridge capacity: Weight limits for loaded horse trailers (minimum 10,000-15,000 lbs capacity); verify any bridges, culverts, or cattle guards can support heavy loads; replacement costs $5,000-$30,000 if inadequate

- Winter maintenance: Snow removal equipment and strategy for year-round access; tractor with blade or professional service; budget $2,000-$5,000 per winter for long driveways; emergency veterinary access requires maintained routes

- Emergency access: Adequate access for veterinary trucks, emergency vehicles, and horse ambulances; emergency services response times increase with poor access; some insurance companies factor access into rates

- Turnaround space: Safe areas to maneuver trailers near barn and loading areas; minimum 60-foot diameter circle for truck/trailer turnaround; backing long distances difficult and dangerous

- Lighting: Consider lighting for driveway and yard areas for safe trailer loading/unloading at night or early morning

Financial Considerations and Costs

Property Valuation Factors

Equestrian properties typically command premium prices due to specialized infrastructure:

- Facility quality: Well-built barns and arenas add $100,000-$500,000+ to property value depending on size, quality, and features

- Arena value: Indoor arenas typically add $150,000-$400,000 depending on size (80x200 vs 100x250) and quality (basic vs heated with amenities)

- Outdoor facilities: Quality outdoor arenas add $20,000-$50,000; round pens $5,000-$15,000 to property value

- Fencing value: Professional horse fencing adds $15,000-$100,000+ depending on acreage; quality fencing significant selling feature

- Acreage premium: Larger properties (20+ acres) with horse facilities often appreciate faster than raw land due to limited supply and strong demand

- Location factors: Properties near recreational areas like Bragg Creek, with mountain views, or major equestrian centers command 10-20% premiums

- Zoning advantages: Properties zoned for commercial equestrian use offer income potential from boarding ($400-$800/month per horse), training ($800-$1,500/month per horse), or breeding operations

- Turnkey operations: Fully operational facilities with established client bases, good reputations, and income history command premium pricing (10-20% over facilities alone)

- Water reliability: Excellent well performance (8-10+ GPM, good quality) adds significant value and buyer confidence; poor wells major deterrent

- Condition and maintenance: Well-maintained facilities with regular upkeep command premiums; deferred maintenance significantly reduces value

Ongoing Operational Costs

Budget for ongoing expenses associated with horse property ownership (excluding actual horse care costs):

- Facility maintenance: Barn repairs and upkeep $2,000-$5,000 annually; arena maintenance and footing replenishment $1,000-$3,000; fencing repairs and replacement $500-$2,000; building painting/staining every 3-5 years $3,000-$10,000

- Utilities: Higher electrical costs for heated waterers ($100-$300 monthly in winter months), barn lighting (LED reduces costs), arena heating if applicable ($200-$600 monthly if heated); total utilities $2,400-$6,000 annually

- Water well maintenance: Pump service and replacement ($1,500-$5,000 every 10-15 years); water testing $150-$300 annually; pressure tank replacement $300-$800 every 10-12 years; well rehabilitation $1,000-$3,000 if needed

- Property taxes: Significant variation based on assessment; potential agricultural tax rates with proper qualification can save $6,000-$12,000 annually (see below); typical residential assessment $3,000-$12,000 annually depending on acreage and improvements

- Insurance: Specialized coverage for equestrian activities and liability ($2,000-$5,000 annually for personal use); higher for commercial operations ($5,000-$15,000); farm and ranch policies cover buildings, liability, equipment

- Pasture management: Fertilization, weed control, and renovation costs ($200-$500 per acre every 3-5 years); soil testing $100-$300; overseeding $50-$150 per acre

- Manure management: Removal and disposal or composting systems ($500-$2,000 annually); commercial removal services $50-$150 per load; composting equipment and maintenance

- Road/driveway maintenance: Grading and repairs for private roads or driveways ($1,000-$3,000 annually); gravel replacement every 3-5 years $2,000-$8,000 depending on length; pothole repairs

- Snow removal: Equipment costs or service contracts ($2,000-$5,000 per winter); tractor with blade $15,000-$40,000 initial investment; fuel and maintenance $500-$1,500 annually

- Equipment: Tractor, mower, trailer maintenance and fuel ($2,000-$5,000 annually); replacement costs ($20,000-$60,000 for tractor every 15-20 years); implements (harrows, spreaders) $2,000-$8,000

- Professional services: Veterinary visits for emergencies or routine care; farrier every 6-8 weeks; feed delivery; equipment repairs

Total Annual Operating Costs: $16,000-$50,000+ depending on property size, facility extent, and management intensity (excluding horse care costs like feed, hay, veterinary, farrier for the horses themselves).

Agricultural Tax Assessment

Properties used for genuine agricultural purposes (including horse breeding or boarding operations) may qualify for agricultural tax assessment, resulting in substantially lower property taxes:

- Requirements: Minimum acreage requirements (typically 10+ acres for horses in Foothills County); demonstrated agricultural production or income; annual application and reporting to municipality

- Qualification criteria: Active agricultural use (boarding typically 5+ horses, breeding operations, hay production); income from agricultural activities (receipts, records); compliance with agricultural operating standards; primary land use must be agriculture

- Application process: Annual application to Foothills County assessment department; submit farm business details, income documentation, land use descriptions; renewal required each year

- Savings: Can reduce property taxes by 50-75% compared to residential rates; example: $10,000 residential assessment reduced to $2,500-$5,000 with agricultural designation; $6,000-$10,000 annual savings on valuable properties

- Documentation: Maintain detailed records of agricultural activities, income, and expenses; business licenses if applicable; lease agreements if boarding; breeding records; hay sales receipts

- Compliance: Must maintain agricultural use and meet provincial and municipal standards; conversion to residential use triggers reassessment at higher rates

- Advisory: Consult with agricultural tax specialists or accountant familiar with farm taxation; proper structure and documentation essential for qualification

Financing Considerations

Equestrian properties may present unique financing challenges requiring specialized knowledge:

- Property classification: Ensure lender understands rural/agricultural property values; specialized rural property appraisers may be required ($400-$800 for appraisal); equestrian facilities may be difficult to value without comparable sales

- Inspection requirements: Specialized inspections for wells ($300-$600), septic ($300-$500), and equestrian facilities ($400-$800) add $1,500-$3,000 to closing costs; standard home inspectors may lack rural/agricultural expertise

- Down payment: Rural properties may require 20-25% down payment (vs 5-20% urban); properties over $1 million often require 30% or more; equestrian properties considered higher risk by some lenders

- Interest rates: May be 0.25-0.50% higher than urban properties due to rural classification and perceived risk; shop multiple lenders for best rates

- Insurance requirements: Lender requirements for equestrian liability coverage and farm insurance; may require minimum $2 million liability; commercial operations need higher coverage

- Income documentation: Boarding or training income can help qualify but requires 2+ years documented history; CRA tax returns showing farm income; business licenses; stable client base

- Appraisal challenges: Finding comparable sales for specialized equestrian facilities can be difficult; unique properties may appraise below purchase price; consider appraisal contingency in offers

- Lender selection: Work with lenders experienced in rural/agricultural financing; Farm Credit Canada specializes in agricultural properties; credit unions often more flexible than major banks

Popular Equestrian Areas in Foothills County

Priddis and Area

Priddis area properties offer exceptional equestrian opportunities with proximity to Calgary (35-45 minutes) and one of Alberta's most established horse communities.

Equestrian Highlights:

- Access to Bragg Creek trail systems (166 km multi-use trails, 25 minutes)

- Active riding clubs, regular clinics and events, strong networking opportunities

- Established horse community with supportive, knowledgeable neighbors

- Numerous professional training facilities and instructors in area

- Spectacular Rocky Mountain views from most properties

- Higher-end market with quality properties and facilities

Property Profile: Typically 5-160 acres with prices from $1.5M-$5M+ for premier equestrian estates; strong demand from Calgary professionals seeking weekend horse properties or retirement estates; properties often feature quality facilities including indoor arenas, extensive fencing, and professional-grade infrastructure.

Recent Development: White Moose Farms approval (22,167 sq ft arena, 28-stall barns) demonstrates area's commitment to quality equestrian facilities and county support for well-planned operations.

️ Millarville Region

Millarville acreages provide excellent horse property options with strong community support for equestrian activities and authentic rural character.

Equestrian Highlights:

- Crown land trail access for extensive backcountry riding

- Annual Millarville races and community events celebrating western heritage

- Historic Millarville Racing and Agricultural Society grounds hosting competitions

- Strong sense of community with welcoming, supportive neighbors

- Rural character with minimal development pressure

- 20 minutes to Bragg Creek trails, 35 minutes to Kananaskis Country

Property Profile: Range from 10-320 acres with varied price points suitable for different budgets ($800K-$4M typical range); mix of hobby farms, serious horse operations, and working ranches; properties often feature mountain views, rolling terrain, and established horse facilities.

Community Character: Families and long-term residents value rural lifestyle; active community association; annual farmers' market and community events; excellent for those seeking authentic rural horse property experience.

De Winton Area

De Winton properties offer the best combination of convenient Calgary access (15-25 minutes) and rural horse property character.

Equestrian Highlights:

- Excellent value for proximity to city - most affordable near-Calgary option

- Flat to gently rolling terrain ideal for horse facilities and riding

- Growing horse community with increasing equestrian focus

- Quick access to Calgary equestrian services, vets, tack shops

- Fish Creek Provincial Park (10-12 minutes) offers extensive trails

- Ideal for horse owners maintaining Calgary employment

Property Profile: Typically 2-40 acres with prices from $900K-$3M; strong demand from horse owners who commute to Calgary daily; mix of small hobby farms (2-5 acres) and larger properties with complete facilities; newer horse properties being developed as area becomes more popular.

Practical Benefits: Shortest commute allows daily horse care before/after work; easy access to urban amenities when needed; good cell service and internet; municipal water available in some areas reducing well concerns.

Additional Equestrian Communities

- Okotoks Area: Excellent town amenities combined with rural horse property opportunities; properties range from small 2-5 acre hobby farms to larger 40+ acre equestrian estates; strong veterinary services (large animal clinic in town), feed suppliers, tack shops; family-friendly with excellent schools and recreation; 30-40 minutes to Calgary; prices $700K-$3M+.

- High River Region: Deep western heritage with strong ranching and equestrian traditions; High River Rodeo Grounds and numerous training facilities; often offers more acreage for competitive pricing compared to areas closer to Calgary; authentic western community with cowboy culture; full-service town with amenities; 45-55 minutes to Calgary; prices $600K-$2.5M.

- Turner Valley / Black Diamond: Mountain access with proximity to Sheep River Provincial Park equestrian trails (18-23 km) and camping facilities; ideal for trail riding enthusiasts; mountain community character with stunning views; 50-65 minutes to Calgary; properties often feature privacy, views, and recreational access; prices $700K-$3M.

Legal and Regulatory Compliance

Provincial Requirements

Alberta's Code of Practice for the Care and Handling of Equines establishes minimum standards for horse welfare and facility requirements. While not legally enforceable in all situations, these codes represent industry best practices and may be referenced in legal proceedings or animal welfare investigations.

Key Requirements Include:

- Adequate shelter from extreme weather conditions (wind, precipitation, temperature extremes below -20°C or above 30°C)

- Access to clean, fresh water at all times (automatic waterers or twice-daily checks minimum)

- Appropriate nutrition for age, workload, and health status (quality hay and/or pasture, supplemental feed as needed)

- Sufficient space for natural behaviors including lying down, rolling, free movement, and social interaction with other horses

- Regular hoof care (typically every 6-8 weeks by qualified farrier)

- Prompt veterinary attention for illness and injury

- Proper handling and training methods using positive reinforcement; prohibition of abusive techniques

- Safe fencing and containment systems appropriate for horses

- Proper transportation in suitable trailers with adequate ventilation

- Appropriate euthanasia when quality of life severely compromised

Enforcement: Alberta SPCA and local peace officers can investigate complaints of animal neglect or abuse; charges possible under provincial Animal Protection Act; industry associations may revoke memberships for code violations; insurance companies may reference codes in liability determinations.

Municipal Compliance

Ensure all existing facilities have proper permits and comply with current bylaws:

- Permit verification: Request copies of all development and building permits during due diligence; verify permits obtained for barns, arenas, and accessory buildings

- Compliance review: Verify all structures meet setback requirements (typically front 15m, side 3m, rear 7.5m) and lot coverage limits (maximum 60%)

- Non-compliant facilities: May require costly upgrades ($10,000-$50,000+) or risk enforcement action; factor into purchase price negotiations; some violations may prevent mortgage approval

- Grandfathering: Some older facilities may be grandfathered under previous bylaws but cannot be substantially altered (>50% reconstruction) without triggering compliance requirements with current standards

- Safety inspections: Buildings constructed without permits may not meet building codes; safety risks and insurance implications; costly to bring into compliance

⚠️ Liability Considerations

Horse-related activities carry inherent liability risks requiring proactive risk management:

- Insurance coverage:Maintain comprehensive liability insurance:

- Personal use: $2-$5 million recommended minimum

- Commercial operations (boarding/training): $5-$10 million minimum

- Coverage includes property, liability, equipment, and loss of use

- Equine mortality insurance available for valuable horses ($100-$400 annually per $10,000 coverage)

- Warning signage: Post appropriate warning signs about equine activity risks at all entry points; "Danger: Horses Can Kick, Bite, or Cause Injury"; visible from public roads and property entrances

- Liability waivers: Implement written liability waivers for all visitors, students, and boarders; consult lawyer for proper wording meeting Alberta requirements; waivers don't eliminate liability but provide some protection; renew annually

- Facility maintenance: Keep all facilities in safe condition; document regular inspections and repairs; address hazards promptly; good maintenance reduces liability exposure and insurance claims

- Business structure: Consider incorporating if operating commercially to separate personal and business liability; limited company or corporation provides asset protection; consult accountant and lawyer

- Professional guidance: Consult with insurance broker specializing in equestrian operations; understand coverage limits, exclusions, and requirements; annual policy review as operations change

- Contracts: Use written boarding, training, and lesson contracts clearly outlining responsibilities and liability; payment terms, care standards, termination procedures; emergency contact information; veterinary authorization

- Risk management: Establish safety rules and procedures; helmet requirements for riders; no unsupervised access by inexperienced persons; proper horse handling training; emergency action plans

Due Diligence for Equestrian Property Buyers

Property Inspection Checklist

Comprehensive inspections essential for avoiding costly surprises:

- Structural assessmentof all equestrian buildings by qualified inspector familiar with agricultural structures ($400-$800); check for:

- Foundation integrity (settling, cracks, moisture)

- Roof condition (shingles, metal, leaks, snow damage)

- Wall structure (plumb, straight, rot, damage)

- Floor condition (level, drainage, rot)

- Door and window function

- Electrical system evaluationfor safety, capacity, and code compliance:

- Service capacity (100-amp minimum for basic barn; 200+ for heated facilities)

- Wiring condition (modern Romex vs outdated knob-and-tube)

- GFI protection near water sources

- Adequate lighting (function and safety)

- Heating system condition if applicable

- Water system testingincluding:

- Flow rate testing (run water extended period noting GPM)

- Recovery rate (well refill after drawdown)

- Water quality analysis by accredited lab ($150-$300): bacteria, minerals, nitrates, pH

- Pump inspection (age, condition, capacity)

- Pressure tank condition and settings

- Distribution system (pipes, fittings, waterers)

- Heated waterer function and condition

- Septic system inspectionfor capacity, condition, and compliance ($300-$500):

- Tank size and age (typical 20-30 year lifespan)

- Field condition and age

- Pumping history (should be every 2-3 years)

- Signs of failure (odors, wet areas, slow drains)

- Capacity adequate for property use

- Reserve area available for future field

- Well camera inspection if possible ($300-$600); identifies casing damage, debris, mineral buildup, or other issues affecting performance and longevity

- Fencing condition assessmentthroughout property:

- Overall condition and remaining lifespan

- Repair/replacement cost estimates

- Safety for horses (no barbed wire, sharp edges)

- Adequacy for intended horse numbers

- Gate function and condition

- Estimate $3,000-$8,000 per acre for replacement

- Drainage evaluationfor barn areas, paddocks, and arenas:

- Standing water issues

- Slope and grading

- Erosion problems

- Impact on buildings and facilities

- Roof conditionof all structures:

- Critical for preventing water damage ($10,000-$50,000 repairs)

- Remaining lifespan (shingles 15-25 years, metal 30-50 years)

- Replacement costs ($5,000-$30,000 depending on building size)

- Foundation integrityof barns and buildings:

- Settling or movement

- Cracks or deterioration

- Moisture intrusion

- Repairs can be $5,000-$50,000+

- Arena footing analysisif indoor arena present:

- Depth and composition

- Condition and compaction

- Drainage adequacy

- Replacement cost estimate ($10,000-$30,000)

- Heating systemsif applicable:

- Inspect all barn heaters, heated waterers, and related electrical

- Function and safety

- Operating costs

- Safety hazards: Identify any immediate safety concerns for horses or people; protruding nails, sharp edges, unstable structures, electrical hazards

Documentation Review

Request and review all relevant documentation during due diligence:

- Development permitsfor all equestrian facilities and structures:

- Verify permits obtained for barns, arenas, commercial operations

- Check expiry dates and approval conditions

- Confirm compliance with permit conditions

- Non-permitted structures risk enforcement action

- Building permitsfor barns, arenas, and outbuildings:

- Confirm all structures built with proper permits

- Verify final inspections completed

- Check for building code compliance

- Insurance may be void for non-permitted buildings

- Water well recordsincluding:

- Drilling logs showing depth, casing, geology

- Completion reports from licensed drillers

- All water quality testing results (request most recent within 6 months)

- Flow rate testing results

- Pump installation and service records

- Septic system documentationincluding:

- Installation records and permits

- Design drawings and specifications

- Inspection reports and approvals

- Pumping history (receipts from service company)

- Alberta Health Services approval if available

- Property surveyshowing all improvements, boundaries, and easements:

- Updated survey preferred (within 5 years)

- Confirms building locations relative to property lines

- Identifies encroachments or boundary issues

- Shows easements, rights-of-way, restrictions

- Title searchfor encumbrances, liens, rights-of-way, or restrictions:

- Current certificate of title

- Registered mortgages, liens, caveats

- Utility right-of-ways

- Restrictive covenants

- Any unusual registrations

- Property tax statements(3 years) including:

- Current tax rates and amounts

- Agricultural assessment status if applicable

- Tax payment history

- Any outstanding balances or penalties

- Utility bills(12 months minimum):

- Electricity costs showing seasonal variation

- Natural gas if applicable

- Understand operating costs for heated facilities

- Identify potential energy efficiency improvements

- Equipment inventoryif included in sale:

- Tractors, trailers, mowers, equipment

- Condition and maintenance history

- Value for purchase price negotiation

- Boarder contractsif purchasing operating facility:

- Review income and liabilities

- Understand existing agreements

- Client base and history

- Terms, rates, obligations

- Insurance claims history: May reveal undisclosed property issues like water damage, foundation problems, fire damage

- Maintenance records: Well pump service, septic pumping, facility repairs demonstrate property care and identify deferred maintenance

Environmental Considerations

Assess environmental factors that may impact property use:

- Flood risk: Check if property in Flood Hazard Overlay District; review flood maps and history; flood-prone areas affect insurance and building restrictions

- Wetlands: Identify any environmentally protected wetland areas; restrictions apply to development near wetlands (typically 30m setback); wetland delineation may be required ($2,000-$5,000)

- Soil quality: Evaluate pasture productivity, drainage, and suitability for facilities; clay soils challenge septic systems; sandy soils better drainage

- Water sources: Identify creeks, ponds, or dugouts on property; confirm water rights if diverting or using surface water; riparian areas protected

- Slopes and grades: Assess land suitable for buildings and paddocks; steep slopes (>15%) restrict development and require geotechnical assessment

- Tree coverage: Windbreaks and natural shelter add value; consider wildfire risk in heavily treed areas (FireSmart principles); clearing costs $1,000-$3,000 per acre

- Sun exposure: South-facing slopes ideal for winter turnout (sun melts snow faster); consider shelter placement relative to prevailing winds and sun

- Prevailing winds: Important for barn and shelter placement; prevailing winds typically west/northwest in Foothills; locate facilities for wind protection

- Wildlife presence: Bears, cougars, coyotes present in Foothills; electric fencing may be necessary; secure feed storage essential; awareness and management strategies needed

Working with Equestrian Property Specialists

Successfully purchasing equestrian property requires working with professionals who understand the unique aspects of horse property transactions. Look for real estate professionals with specific experience in rural acreage properties and equestrian facilities.

Key Professional Qualifications:

- Extensive experience with rural property transactions in Foothills County (10+ years preferred); proven track record with equestrian properties

- Understanding of municipal zoning (animal unit regulations, development permit requirements) and development permit processes

- Knowledge of equestrian facility requirements, construction standards, and accurate valuation methods

- Network of qualified rural property inspectors and specialists including:

- Well drillers and water testing services

- Septic system designers and installers

- Equine facility contractors and builders

- Agricultural appraisers understanding equestrian property values

- Rural property inspectors with barn/arena expertise

- Familiarity with rural financing options, lender requirements, and agricultural tax assessment qualifications

- Connections within the local equestrian community providing insights on facilities, services, and community character

- Understanding of agricultural tax assessment qualifications and application procedures

- Experience negotiating rural property contracts with appropriate conditions (well testing, facility inspections, permit verification)

- Knowledge of current equestrian property market trends, values, and demand in various Foothills communities

Additional Professional Team Members

Consider assembling a team that includes:

- Real estate lawyerwith rural property experience ($1,500-$3,000 for purchase):

- Understand easements, water rights, agricultural leases

- Review restrictive covenants and title restrictions

- Handle closing and title registration

- Prepare boarding or lease agreements if needed

- Accountantfamiliar with farm taxation and agricultural operations ($200-$400 hourly):

- Advise on agricultural tax assessment qualification

- Farm income and expense structuring

- Tax implications of boarding or training income

- Business structure recommendations (sole proprietor, corporation)

- Insurance brokerspecializing in farm and equestrian coverage ($2,000-$5,000 annually premiums):

- Understand unique risks of equestrian operations

- Farm and ranch insurance packages

- Liability coverage for boarding or training

- Equine mortality insurance if valuable horses

- Equine veterinarianto evaluate facilities ($200-$400 consultation):

- Assess facilities from horse health and welfare perspective

- Identify safety hazards or design flaws

- Recommend improvements for horse wellbeing

- Establish ongoing veterinary relationship

- Professional trainerto assess arena and training facilities ($200-$500 consultation):

- Evaluate suitability for intended discipline

- Assess footing quality and maintenance needs

- Identify facility strengths and limitations

- Recommend improvements or modifications

- Agricultural engineerfor large facility construction or major renovations ($150-$250 hourly):

- Design plans for barns, arenas, or infrastructure

- Structural assessments of existing facilities

- Permit drawings and specifications

- Cost estimates for construction projects

- Farrierfor insights on barn design and horse management facilities (typically free consultation if establishing client relationship):

- Evaluate work areas and cross-tie setups

- Assess safety for shoeing operations

- Recommend practical improvements

Future Considerations and Property Potential

Expansion Possibilities

Consider the property's potential for future development:

- Additional facilities: Adequate space and proper zoning for additional barns, arenas, or specialized structures (round pens, breeding facilities, hay storage); infrastructure capacity (electrical service, well capacity, septic system) adequate for expansion

- Commercial opportunities: Zoning potential for expanding into boarding ($400-$800/month per horse), training ($800-$1,500/month per horse), or breeding operations; market demand in area for services; development permit requirements if commercial use

- Subdivision potential: Ability to create additional parcels while maintaining equestrian use on retained portion; subject to Foothills County subdivision regulations and minimum lot sizes; consult subdivision guide for process details

- Infrastructure capacity: Electrical service (100-200+ amp), well capacity (8-10+ GPM), and septic system adequate for expansion; existing utilities can serve additional facilities without major upgrades

- Road access: Ability to create additional accesses if subdividing; adequate turning radius and road width for expanded operations

- Additional dwellings: Potential for guest house, manager's residence, or second home; properties 80+ acres allow two dwellings; useful for live-in help or rental income

- Event hosting: Space and zoning for hosting clinics, shows, or equestrian events; parking area, spectator facilities; neighbor compatibility

- Agritourism: Potential for farm stays, riding lessons, trail rides, or other equestrian tourism ventures; insurance and liability considerations; business licensing requirements

Investment Potential

Quality equestrian properties often appreciate faster than standard rural properties:

- Limited supply: Well-developed horse properties in prime Foothills locations scarce; new development limited by zoning and agricultural land protection

- Strong demand: Growing Calgary-area equestrian community seeking quality facilities; influx of buyers from more expensive markets (BC, Ontario)

- Infrastructure value: Buildings and facilities typically appreciate while land appreciates; quality improvements add lasting value

- Income potential: Boarding income ($400-$800 per horse monthly) can offset carrying costs or mortgage payments; training, lessons, breeding add revenue streams

- Proximity to Calgary: Land values driven upward by Calgary growth; historical appreciation 3-5% annually in Foothills region; properties within 45 minutes most desirable

- Lifestyle desirability: Rocky Mountain viewscapes, outdoor recreation access, and rural lifestyle maintaining strong buyer appeal regardless of market conditions

- Tax advantages: Agricultural tax assessment significantly reduces carrying costs ($6,000-$12,000 annual savings on valuable properties); improves cash flow and investment returns

- Recreation access: Properties near trail systems (Bragg Creek, Sheep River, Kananaskis) command 10-15% premiums with stronger appreciation

- Quality over quantity: Well-maintained properties with quality facilities appreciate faster than larger properties with poor improvements

Climate and Seasonal Considerations

Alberta's climate presents unique challenges for equestrian property management:

- Winter preparation: Adequate shelter (barns or three-sided shelters minimum), heated water systems mandatory, and winter turnout management strategies; expect 4-5 months of winter conditions (November-March); horses need windbreaks and protection from -20°C to -40°C temperatures

- Mud management: Spring thaw (March-April) and fall rains require proper drainage and sacrifice paddocks to protect pastures; sacrifice areas (gravel or sand base) save pastures from damage; horses on muddy pastures develop hoof problems (thrush, abscesses)

- Pasture management: Short grazing season (May-October, approximately 150 days) requires hay production on property or reliable hay sources; budget $150-$300 per ton for quality hay; average horse consumes 1.5-2 tons per winter; rotational grazing extends pasture productivity

- Snow removal: Equipment and strategies for maintaining barn access, driveways, and critical areas; tractor with blade minimum $15,000-$40,000 initial investment; budget $3,000-$6,000 annually for fuel and maintenance; professional service $2,000-$5,000 per winter for long driveways

- Ice management: Safe footing in barn areas, paddocks, and walkways essential; use sand, sawdust, or wood shavings (salt damages horse hooves); heated mats for high-traffic areas; horses slip and injure themselves on ice

- Summer heat: Shade structures (trees or run-in sheds), adequate water (consumption doubles in hot weather), and fly control essential for horse comfort; temperatures can reach 30°C+; horses need relief from sun and insects

- Chinooks: Warm winter winds create freeze-thaw cycles and icy conditions; manage carefully with sand or shavings; rapid temperature swings (from -20°C to +10°C in hours) stress horses; blanketing strategy needed

- Seasonal facility demands: Higher electrical costs in winter (heated waterers, barn lighting); water system maintenance (freeze prevention, pipe protection); increased bedding needs (horses inside more); additional labor for snow removal and winter chores

Frequently Asked Questions

Q: How many horses can I keep on my Foothills County property?

Foothills County regulations allow 1 horse per 3 acres without a development permit. For example, a 10-acre property can accommodate 3 horses, while a 30-acre property allows 10 horses. Higher densities require a development permit demonstrating adequate facilities, water supply, manure management, and compatibility with surrounding land uses. Always verify specific requirements with the county planning department (403-652-2341) as regulations may vary by zoning designation. Review the complete Keeping of Livestock regulations for detailed requirements.

Q: Do I need special permits to run a horse boarding or training business?

Yes, commercial boarding operations, training facilities offering lessons to non-residents, and limited public arenas require development permits from Foothills County. The county reviews these applications to ensure compliance with land use bylaws, neighborhood compatibility, facility standards, and adequate infrastructure (water, waste management, parking, road access). The application process typically takes 4-8 weeks and requires site plans, operational details, and sometimes neighbor consultation. Budget $1,000-$3,000 for application fees and professional site plan preparation. Commercial operations also require business licenses, liability insurance ($5-$10 million coverage), and compliance with Alberta's equine care standards.

Q: What should I look for in a well for a horse property?

A reliable well should provide minimum 3-5 gallons per minute flow rate for basic horse operations (1-4 horses), with 8-10 GPM strongly recommended for boarding facilities (5+ horses). Horses require 5-10 gallons of water daily each, so calculate total needs based on planned herd size plus household use. Request well logs showing depth (200+ feet typical in Foothills), static water level, and drilling records. Obtain recent water quality test results (within 6 months) for bacteria (E. coli, Total Coliforms must be "Not Detected"), minerals (iron, manganese, hardness), nitrates, and pH. Test recovery rate by running water for extended period noting how quickly well refills after drawdown. Always conduct a professional well inspection ($300-$600) before purchasing, including pump condition, capacity verification, and system assessment. Budget $1,500-$5,000 for well pump replacement every 10-15 years.

Q: Can barbed wire fencing be used for horses?

While not explicitly prohibited by regulations, barbed wire fencing is strongly discouraged and considered highly unsafe for horses. Barbed wire poses severe injury risks including deep cuts requiring veterinary sutures ($200-$1,000 per wound), leg entanglement causing panic and broken bones ($3,000-$10,000+ treatment), permanent scarring affecting show horse value, eye injuries from contact (can cause blindness), and increased insurance premiums or coverage denials. Horse-safe fencing options include wood board ($7-$15 per linear foot, requires maintenance), vinyl ($15-$25 per linear foot, low maintenance), or electric tape designed for horses ($1-$3 per linear foot plus posts). Investment in proper fencing protects your horses (veterinary bills far exceed fencing costs) and maintains property value (buyers avoid properties with barbed wire). Most equestrian insurance policies have restrictions or higher premiums for properties using barbed wire for horse containment.

Q: What type of barn shelter do horses need in Alberta?

Alberta's climate requires substantial shelter due to extreme winter temperatures (down to -30°C or colder), heavy snowfall, and strong winds. Minimum requirement is a three-sided shelter or run-in shed (minimum 12x12 feet per horse) that protects from wind, precipitation, and temperature extremes. Most horse owners prefer barns with individual stalls (10x10 for ponies, 12x12 for average horses, 14x14 for draft breeds or foaling), proper ventilation (cupolas, ridge vents) to prevent respiratory disease, adequate lighting for safety and horse care (LED reduces costs 60-75%), heated water systems for winter ($500-$2,000 per automatic waterer), secure feed and tack storage (rodent-proof, climate-controlled), and proper drainage preventing moisture buildup. Indoor arenas ($150,000-$400,000) provide year-round riding opportunities essential for training programs and serious riders. Budget $40,000-$80,000 for basic barn with 4-6 stalls, or $100,000-$250,000+ for higher-quality facilities with amenities (heated, concrete aisles, wash bays, tack rooms).

Q: Are there equestrian communities and trail systems in Foothills County?

Yes! Foothills County offers exceptional equestrian recreation. Millarville, Priddis, and Bragg Creek feature particularly strong equestrian communities with established trail systems, riding clubs, and regular equestrian events. Sheep River Provincial Park (23 km from Turner Valley) provides designated equestrian trails and dedicated horse camping facilities with corrals, staging areas, and 50+ km of riding trails. Bragg Creek area offers 166 km of multi-use trails accommodating horseback riding with multiple trailheads. Many acreage areas provide direct access to rural trail networks and Crown land riding opportunities. Active equestrian clubs host clinics, shows, and social events throughout the year. See our Parks & Recreation Guide for complete trail information, access points, and seasonal availability.

Q: What are typical property taxes for equestrian acreages in Foothills County?

Property taxes vary significantly based on property size, improvements, and agricultural tax assessment status. Residential assessment rates substantially higher than agricultural rates. Example: 20-acre property with $2 million assessed value might pay $8,000-$12,000 annually under residential assessment, but only $2,000-$4,000 with agricultural assessment - a 50-75% savings ($6,000-$10,000 annual reduction). To qualify for agricultural assessment, you must demonstrate genuine agricultural use (horse breeding with foals produced, boarding operations typically 5+ horses, hay production, other agricultural activities), meet minimum acreage requirements (typically 10+ acres for horses), apply annually with documentation (income records, business details, land use descriptions), and maintain detailed records. Contact Foothills County assessment department (403-652-2341) or consult with agricultural tax specialist or accountant familiar with farm taxation for specific property tax information and agricultural assessment qualification guidance. Proper structure and documentation essential for qualification.

Q: Should I hire a specialized real estate agent for equestrian property purchases?

Absolutely essential. Equestrian properties require specialized knowledge that typical residential agents don't possess. Experienced rural agents understand horse property zoning regulations (animal unit systems, development permit requirements, setbacks), facility valuation (how much barns add: $100,000-$500,000+, arenas: $150,000-$400,000, fencing: $15,000-$100,000+), water and septic system requirements (flow rates 3-10 GPM, septic capacity for barn facilities), equestrian facility inspection requirements, agricultural tax assessment qualifications (saving $6,000-$12,000 annually), rural financing challenges (20-30% down payment often required, specialized lenders), and have networks of specialized inspectors (rural property, well, septic, equestrian contractors). They can identify red flags like inadequate well capacity ($8,000-$20,000 to drill new well), non-permitted structures ($10,000-$50,000 to correct), or zoning restrictions that could cost tens of thousands post-purchase. The right agent saves far more than their commission through better negotiation, proper due diligence, and avoiding costly mistakes. Look for 10+ years rural property experience, proven equestrian property sales, and strong professional network.

Q: What is the minimum acreage needed for keeping horses?

While Foothills County regulations technically allow horses on properties as small as 3 acres (for 1 horse meeting the 1 unit per 3 acres rule), practical considerations suggest different minimums for sustainable horse keeping. 2-5 acres works for 1-2 horses with excellent pasture management (rotational grazing, sacrifice paddocks), significant hay supplementation (horses can't live on small acreage pasture alone), and intensive management. Most horse owners find 5-10 acres provides comfortable space for a small personal herd (3-4 horses) with adequate pasture rotation (3-4 paddocks), seasonal turnout management, and ability to rest pastures. 10-20 acres ideal for larger herds (5-7 horses) or small boarding operations with proper facility spacing, adequate pasture for partial grazing support, manure management areas, and multiple paddocks. Consider that horses require facilities beyond grazing space: barn or shelters, manure storage (90m from wells), sacrifice paddocks for winter/mud seasons, riding areas, equipment storage, and adequate separation between facilities and property lines. Quality property management more important than quantity - 5 well-managed acres with excellent facilities, drainage, and pasture rotation beats 20 poorly managed acres with inadequate facilities and overgrazed, damaged pastures.

Q: How much does it cost to maintain a horse property annually?

Annual operating costs for horse properties vary widely based on property size, facility extent, and intensity of use. Budget for: Utilities ($2,400-$6,000 annually with heated waterers adding $1,200-$3,600 in winter months), Facility Maintenance ($3,500-$10,000 for barn/arena/fencing repairs, painting every 3-5 years, roof maintenance), Property Taxes ($2,000-$12,000 depending on assessment status; agricultural assessment saves $6,000-$10,000), Insurance ($2,000-$5,000 for property and liability coverage; higher for commercial operations), Pasture Management ($1,000-$3,000 for fertilization, weed control, overseeding), Manure Management ($500-$2,000 removal/composting), Road/Driveway Maintenance ($1,000-$3,000 grading, repairs, gravel), Snow Removal ($2,000-$5,000 per winter equipment/service), Equipment ($2,000-$5,000 for tractor/mower/trailer maintenance and fuel), Well/Water System ($200-$1,000 maintenance, testing, repairs). Total: $16,000-$50,000+ annually excluding the actual horse care costs (feed/hay $2,000-$4,000 per horse annually, veterinary $300-$1,000+ per horse, farrier $960-$1,800 per horse at $80-$150 every 6-8 weeks). Agricultural tax assessment can save $6,000-$10,000 annually significantly reducing total carrying costs. Proper budgeting essential before purchasing equestrian property.

Q: What should I know about buying property with an existing boarding operation?

Purchasing property with operating boarding business requires additional due diligence: Financial Review: Request 2-3 years financial statements showing income, expenses, profit margins; verify boarding rates ($400-$800/month per horse typical); assess client retention and payment history; understand seasonal fluctuations. Existing Contracts: Review all boarder agreements noting terms, rates, services included (feed, bedding, turnout), termination clauses, liability waivers; understand which boarders transfer with sale vs terminate. Permits and Licenses: Verify development permit for commercial boarding operation; business licenses current; compliance with all municipal requirements; insurance adequate ($5-$10 million liability minimum). Facility Assessment: Evaluate facility capacity and condition; deferred maintenance costs; adequacy for current operation; expansion potential. Reputation: Research business reputation in equestrian community (online reviews, word-of-mouth); quality of care provided; customer satisfaction; any complaints or issues. Transition Planning: Negotiate transition period with seller (30-90 days) for introductions and knowledge transfer; understand daily routines, feeding programs, supplier relationships, emergency protocols. Income Potential: Assess realistic income expectations; vacancy rates; pricing relative to competition; potential for growth. Boarding income can offset mortgage ($4,000-$8,000 monthly for 10 horses at $400-$800 each) but requires significant daily labor and management commitment. Consider whether you want business responsibility or prefer personal use property.

Your Gateway to Foothills County Equestrian Properties

Foothills County offers unmatched opportunities for equestrian enthusiasts seeking world-class horse properties in a spectacular natural setting. From intimate hobby farms perfect for 1-2 horses to commercial equestrian operations with world-class training facilities, the region provides options for every level of horse involvement and budget.

The combination of horse-friendly regulations (1 horse per 3 acres baseline, supportive development permit process for quality facilities), established equestrian communities with active riding clubs and events, proximity to Calgary (15-60 minutes from major communities allowing urban employment while maintaining rural horse lifestyle), stunning Rocky Mountain views, and exceptional recreation access (Sheep River Provincial Park, Bragg Creek trails, Kananaskis Country within 50 km) makes Foothills County Alberta's premier destination for equestrian property ownership.

Whether you're seeking a small hobby farm for weekend riding, a serious training facility with indoor arena and professional amenities, or a commercial boarding operation generating income, Foothills County offers properties matching your equestrian goals and budget. Strong market fundamentals including limited supply of well-developed properties, growing Calgary-area population seeking rural lifestyle, and sustained demand from equestrian buyers suggest continued appreciation and investment potential.

Ready to explore luxury equestrian properties, acreages for sale, or development land for your dream horse facility? Contact the experienced team at Alberta Town and Country for expert guidance in finding the perfect equestrian property to support your horse ownership goals.

Ready to Find Your Perfect Foothills County Horse Property?

Expert guidance on equestrian properties, zoning requirements, facility evaluation, and horse property financing

Your Foothills County Equestrian Property Specialist

Diane Richardson specializes in Foothills County equestrian properties and horse farms, providing comprehensive guidance including facility evaluation, zoning compliance review, equestrian infrastructure assessment, and horse property market analysis. With extensive knowledge of animal unit regulations, development permit requirements, barn and arena specifications, and rural property financing options, Diane helps equestrian buyers find properties that perfectly match their horse ownership goals and operational needs.

- Services: Horse property evaluation | Zoning compliance | Facility assessment | Equestrian market analysis

- Phone: 403-397-3706 (Call or text for horse property consultation)

- Email: Diane@Mypadcalgary.com

- Properties: Horse properties | Equestrian acreages

- Resources: Zoning regulations | Inspection checklist

Include your horse operation needs, facility requirements, acreage preferences, and budget range for personalized equestrian property recommendations and expert evaluation guidance.

Request Equestrian Property ConsultationAdditional Foothills County Resources:

- All Foothills County Homes for Sale

- Rural Foothills County Properties

- School Districts Guide - Family considerations for horse properties

- Parks & Recreation Guide - Trail access and outdoor opportunities

- Property Regulations Guide - Zoning and development requirements

- Septic and Well Inspection Checklist - Essential due diligence information

- Subdivision Guide - Property development opportunities

Information current as of October 2025. Zoning regulations, permit requirements, and property taxes subject to change by municipal and provincial authorities. All buyers should verify current regulations and requirements directly with Foothills County before purchase. Property values, costs, and financial information provided as general estimates and may vary significantly based on specific property characteristics, market conditions, and individual circumstances. Always conduct comprehensive due diligence including professional inspections, legal review, and consultation with qualified real estate, legal, and financial professionals before purchasing equestrian property. Horse ownership and equestrian activities carry inherent risks; proper training, equipment, insurance, and safety practices essential.

All information herein deemed reliable but not guaranteed. Real estate services provided by Diane Richardson, Alberta Town and Country. Copyright © 2025, Alberta Town and Country, all rights reserved.